Health insurance after job loss

What you need to know about health insurance if you are laid off or terminated

Along with all the other stress of job loss or change, uncertainty about your insurance is a concern you don't need at this time. If you were covered under an employee plan, your benefits will change and eventually stop. Here are a few points to help you understand what happens to your health insurance after termination and what to consider in order to protect yourself and your family.

If you are temporarily laid off

While not required, coverage is often continued through the duration of the temporary layoff, typically up to 3 months. However, this timeframe is at the discretion of your employer. It’s important to ask how long each benefit will remain in place (life, disability and health insurance). Maintaining benefits coverage is one factor that may allow a temporary layoff to extend beyond three months. However, extension is not the usual practice and requires specific agreement between the insurance company and your employer.

If you've been terminated now or temporary lay off turns into permanent termination

Benefits can continue for a short period after your job ends but the length of time varies. It is based on a formula of factors including the rules in your province, your length of service and the terms of your job / employment contract. It’s important to receive specifics from your former employer about the end date of your benefits and check your provincial legislation to ensure your rights are met. You can see guidelines for Ontario requirements for the period following notice of termination here.

Options to replace your benefits exist but some are only open for a short time after your current plan ends.

If you’ve been terminated or are otherwise losing your coverage, there are other good plans to consider. Some are tied directly to the date your current plan ends and only available for a short time. It’s important to know that you don’t necessarily have to go with the option your employer or current benefit provider suggests. If you’re healthy, you’ll find better value at lower cost elsewhere. What’s important is that you gather the information now. You don’t want to miss a deadline for transfer to a new plan, pay too much, or take the risk of having no insurance at all.

We strongly advise you to talk to your employer and an insurance advisor now.

These typical practices are guidelines only and not cast in stone. Unusual circumstances could result in something entirely different. If an employer shuts down the business, declares bankruptcy or is going through financial hardship such as the pandemic-caused downturn, there are no hard and fast rules about continuing employee benefits and no guarantees for you. We advise you to get the facts now about the status of your benefits and understand your options for disability, life and especially health insurance.

We're always glad to answer your questions and especially in these uncertain times.

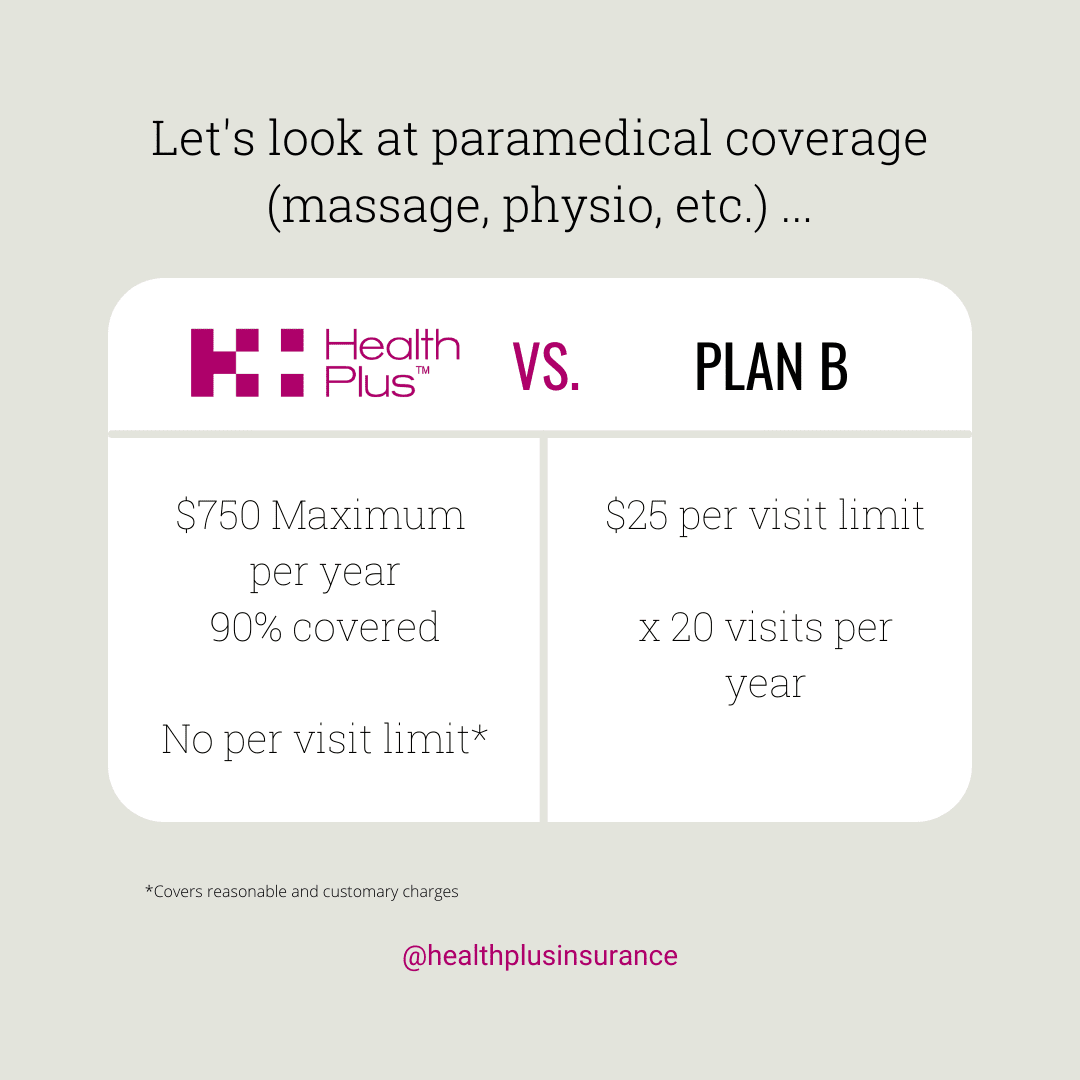

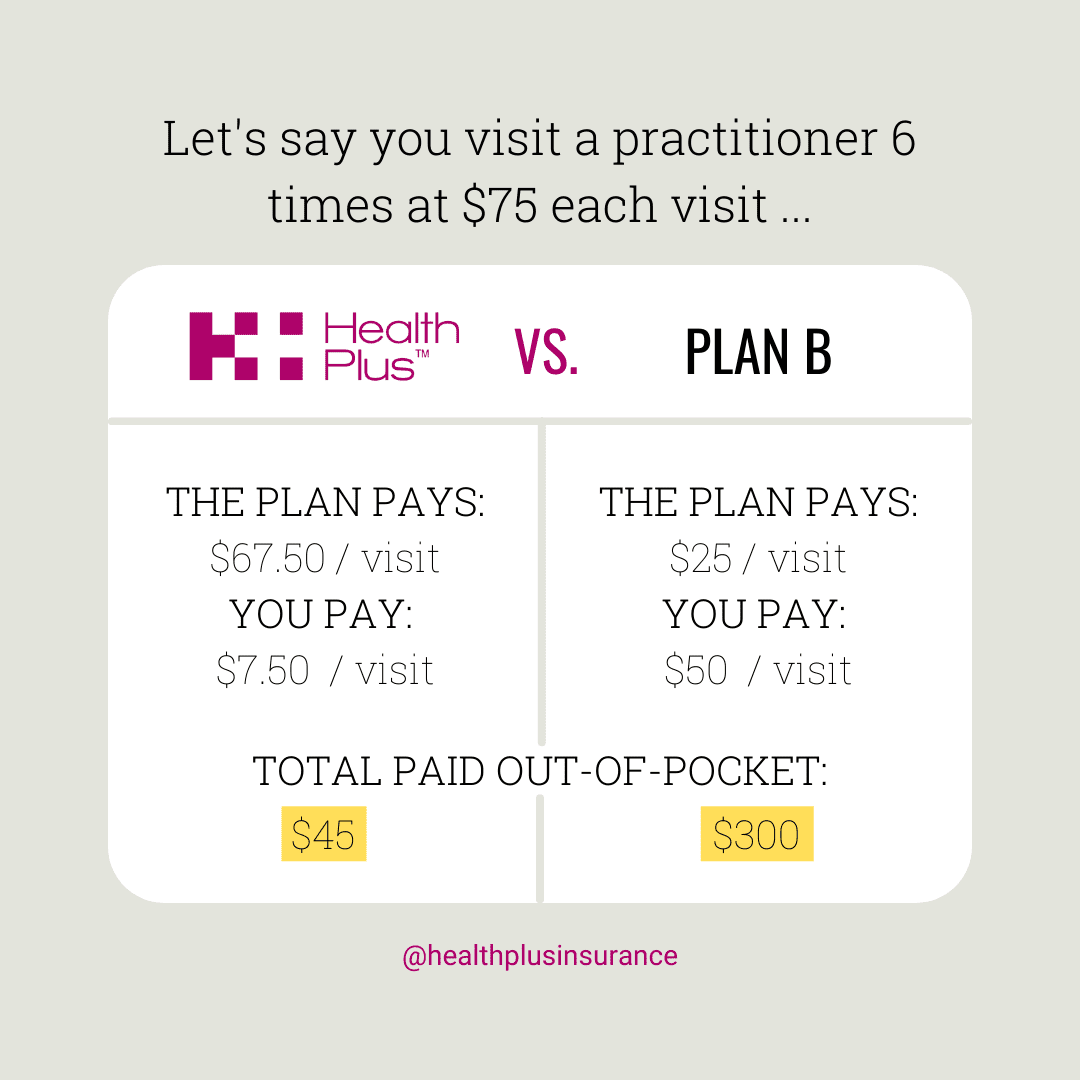

Note: If you’re a business owner who has let people go or need coverage yourself, Health Plus plans are a very good option to suggest to your people or consider for yourself in place of a typical employee plan. They are more affordable and flexible than traditional group insurance. Visit Health Plus for Teams for more information on benefits for owners and teams or contact us.