How health insurance helps you meet your financial goals

How health insurance helps you meet your financial goals

New year, new $ plan ... but are you missing a key piece?

By now, most of us have started work on our 2020 resolutions (unless we’ve already tossed them). Often, those intentions involve money especially if you’re self-employed or freelance. That’s great. But sometimes, the financial picture is missing a critical piece ... one that can support your other goals or when it's not in place, put your entire plan at risk. Not so great. Let us explain.

You already know it’s smart to keep an emergency fund, avoid debt, set regular savings goals, invest wisely. What could possibly go wrong?

The strategy that’s missing is health insurance. Yes we know…not an exciting topic. Much less fun than visions of income breakthroughs and new projects. But insurance is key to good planning and risky to neglect. And if you do have insurance but don’t pick the right plan, you’re spending more than you need to for less protection than you want. So how does that happen?

When you’re thinking about health insurance, watch out for these traps:

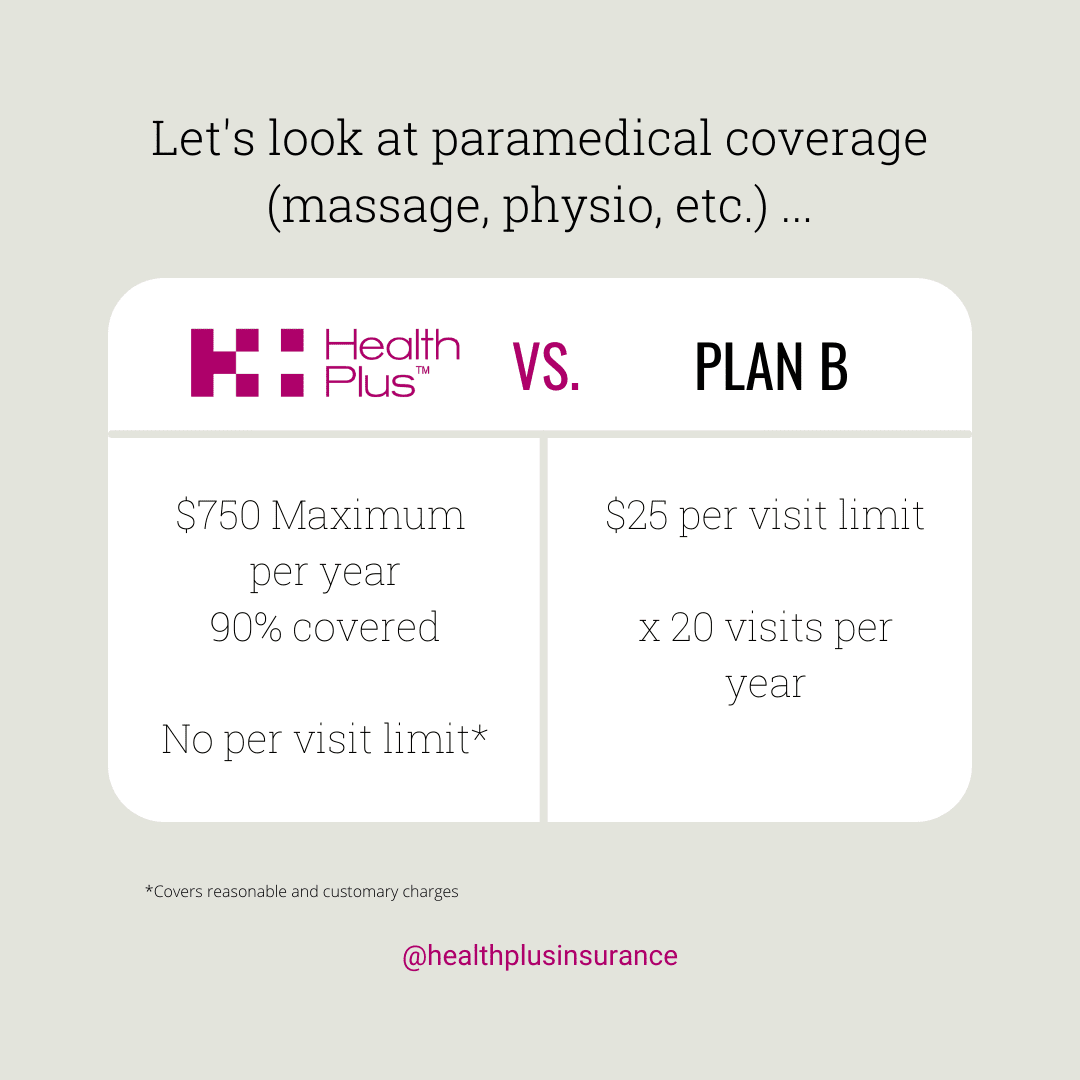

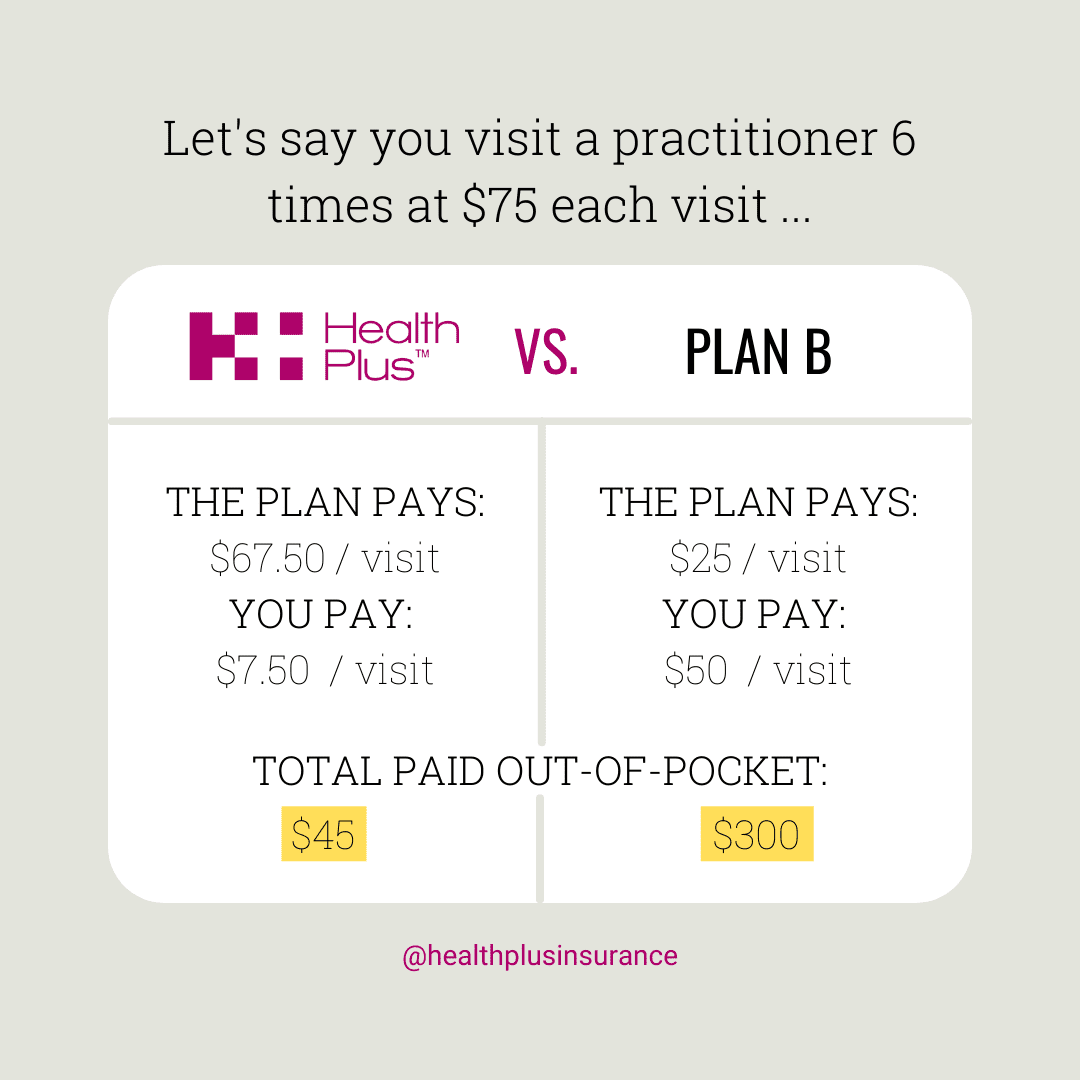

#1 Settling for the first plan you come across from any big company you recognize. Instead, it’s smart to look further to compare options, and easier than you think. Check out the plans from people who specialize in benefits designed solely for small business; they’re almost always much better value. See how Health Plus plans compare.

#2 Counting on an emergency fund (or worse, a line of credit or lottery win). Assuming you’ve stuck to your plan to keep a rainy-day account, do you seriously want to spend it on health bills? What if you just paid for a big-ticket business need or unexpected personal expense when, as luck would have it, an even bigger medical bill comes along. Or you need the money to manage routine bills when a health issue takes you out of action.

The fact is that even if you’re the best of savers, an emergency fund may simply not be enough to cover rehab physio, high-priced prescription drugs, or major dental work. Even if it is, we’re guessing you have more appealing plans for your funds. Why pay bills you don’t have to? What’s more, if you don’t have the cash for a surprise health expense, there goes your ‘avoid debt’ strategy. The ripple effect can do a lot of damage to your entire financial plan.

#3 The problem with good health ... Of course, there’s never a problem with good health. It’s what we wish for everyone. But there is a problem when we take good health for granted. While you may be lucky, with good genes and healthy habits, the fact is accidents happen and serious illness can strike out of the blue. An ‘invest wisely’ plan includes investing in insurance. You cover healthcare costs now and in future without derailing the rest of your goals.

#4 ‘Planning’ to save. Setting goals for regular saving is smart. But too often the follow-through takes a back seat to more ‘urgent’ spending. From retail therapy to essential system upgrades, a lot can come between you and your best intentions. With insurance, you can budget a predictable, affordable monthly amount, tax-deductible if you’re self-employed. Less than a latté a day buys serenity and confidence knowing your healthcare funds are solidly in place, and your insurance can save you big money in the long term.

“The best time to plant a tree was twenty years ago”. To paraphrase the proverb…the best time to buy insurance is when you’re healthy. If you wait until you ‘need it’ you may not qualify at all or you’ll pay much more. Please consider a second look at your financial picture. And best of luck with all of your resolutions this year.

Health Plus Insurance plans are designed for business owners, freelancers, contract workers and self-employed people. For more options and better, more affordable coverage plus complimentary professional Wellness Resources that come with our plans, contact Health Plus Insurance.