‘No Medical Questions’ Health Insurance … when it’s the best financial choice and when it’s not

When you’re shopping for personal health insurance, you'll likely see plans encouraging you to simply sign up …no medical questions asked. Sounds appealing, of course. While ‘no medical questions’ health insurance plans are ideal for some people in some circumstances, for others they are clearly not the best choice. In fact, taking a 'no questions' plan may mean you end up paying more than necessary for less coverage than you could readily get elsewhere. Here’s what you need to know to help you get the right plan for you and the most for your money.

When reviewing health insurance plans there are two kinds to be aware of ...

Guaranteed Acceptance

This is ‘no medical questions asked’ health insurance. It’s ideal for people with serious health issues (pre-existing conditions in insurance jargon), or people who have high ongoing prescription drug bills. If that’s your situation, you may not qualify for other insurance. Or if you do, your rates will be high based on your health history and coverage for your particular condition may be excluded. A guaranteed acceptance (GA) plan which doesn’t ask anything about your health and guarantees your acceptance may well be what you need. Some of your health bills will automatically be covered and fortunately there are a few good GA plans out there. But please read on before you come to any conclusions.

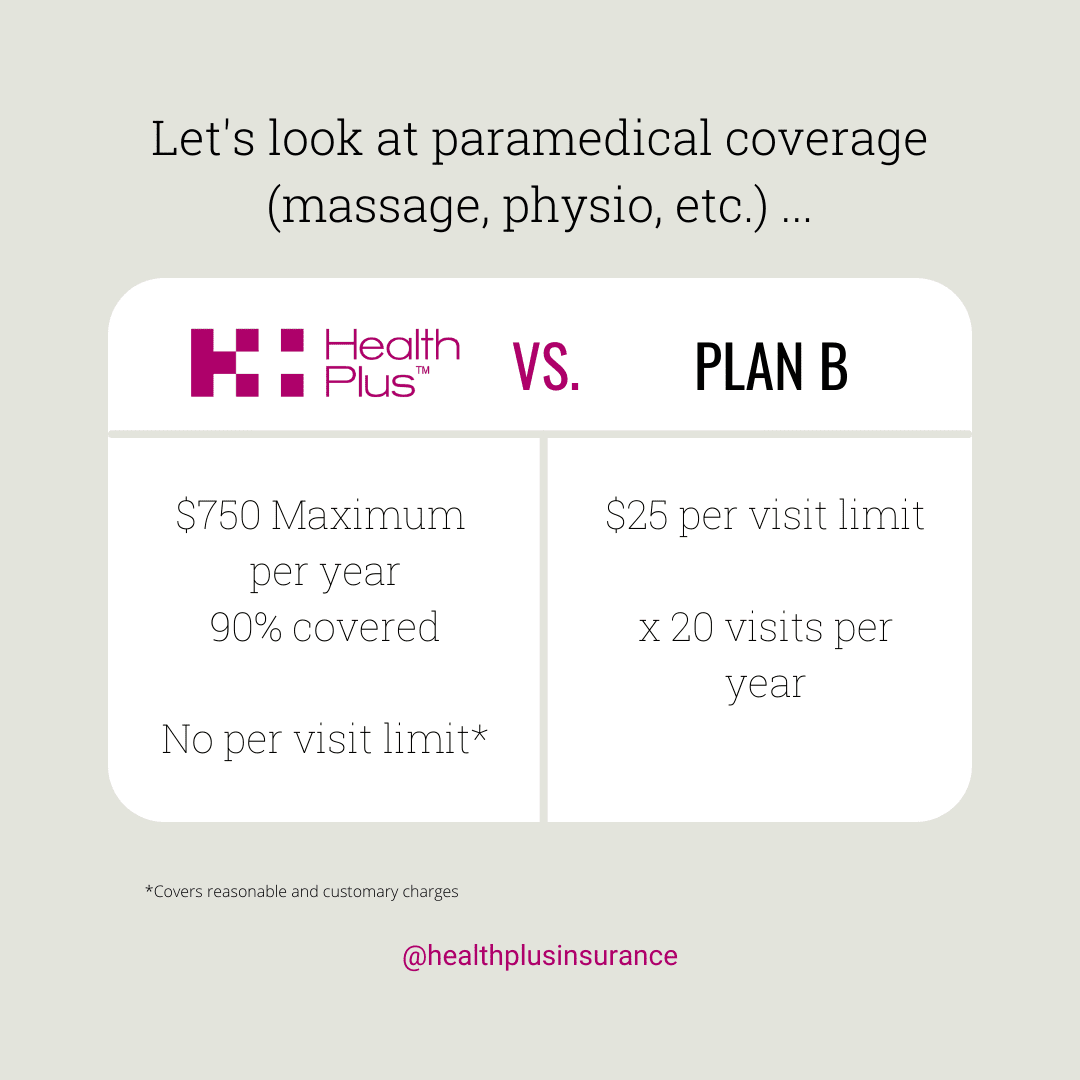

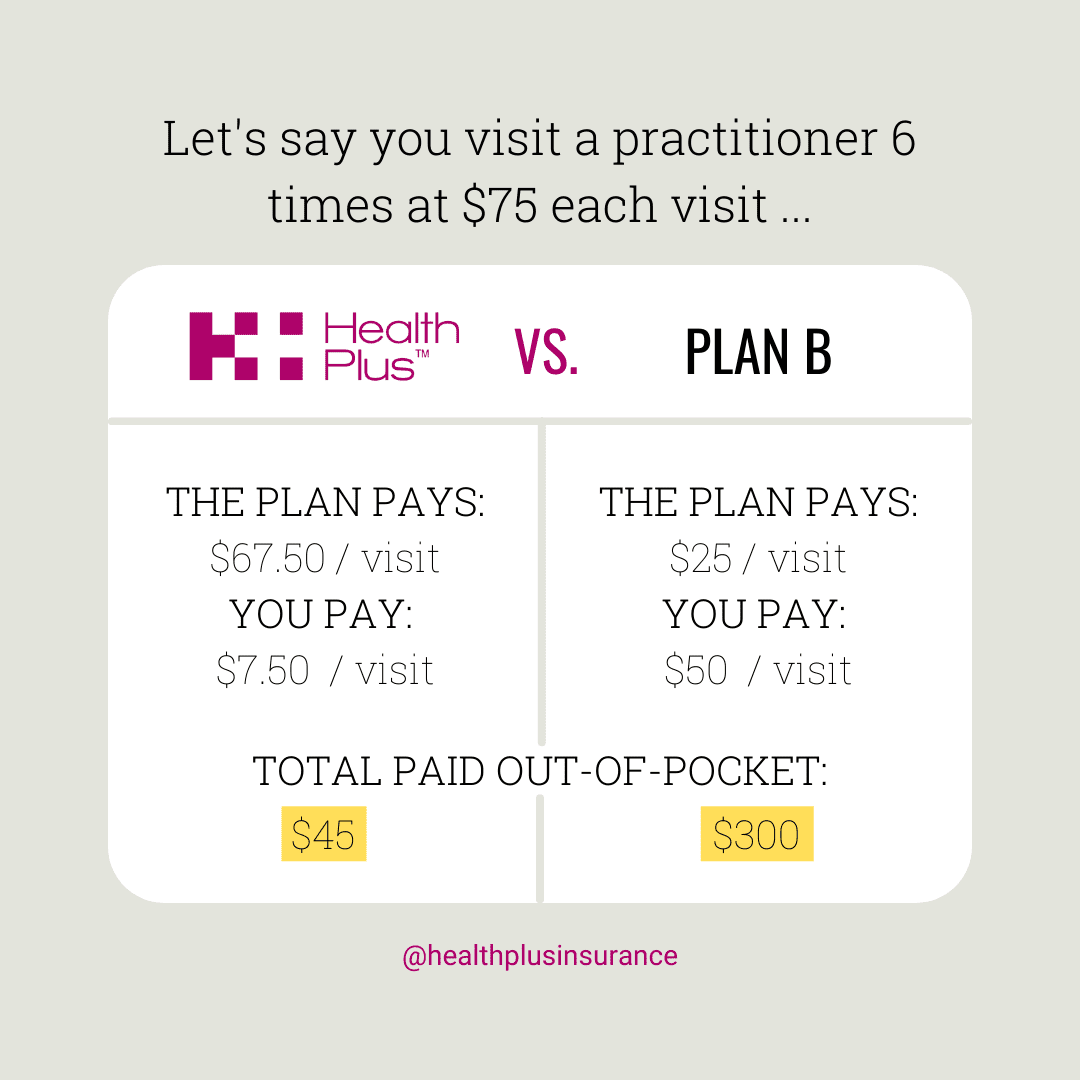

Medically Underwritten

That’s the industry term for plans that ask questions about your health before accepting you for coverage. To be clear, these ‘need-to-qualify’ plans can also be very easy to enrol in but will require filling out a simple health questionnaire. It only takes 5-10 minutes to provide your health profile. If you’re generally healthy, it's worth your time. Insurance companies ask health questions to reduce the level of risk they take on, which in turn allows them to offer better plans. With this type of plan you’ll get more and better coverage at much better rates. It’s an expensive mistake to settle for a GA plan if you don’t have to.

Which type of plan is right for you?

The state of your health makes the difference. For people with certain chronic or past health issues or high drug bills, a Guaranteed Acceptance plan may be the best or even the only option. If you’re generally healthy with no problematic history, a Medically Underwritten plan will cost you less and cover more. And you don’t necessarily have to be in perfect health to qualify. Conditions that are considered minor or are sufficiently in the past may not hinder acceptance into a plan that is medically underwritten.

If you’re uncertain what you qualify for, go ahead and complete a health questionnaire (here’s the easy online one for Health Plus plans). A good advisor can quickly tell you which route makes financial sense for you. No question, the best time to apply for health insurance is when you’re healthy. But if you’re not, it’s not too late to put good protection in place.